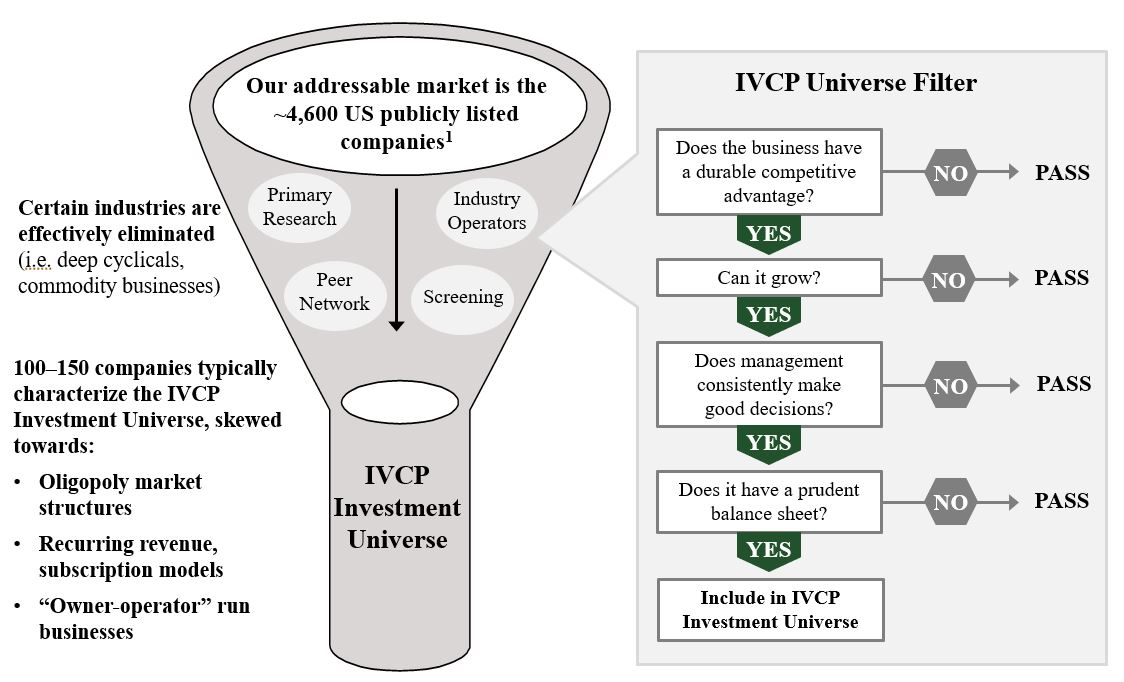

As a nimble, focused team, wisely allocating research time is paramount. We narrow the market of U.S. public companies into a carefully-curated universe of businesses that possess the qualitative and quantitative characteristics that create lasting value for owners. It is within this collection of businesses that we spend the vast majority of our research time, developing a deeper—and at times differentiated—understanding of individual companies and industries.

ECONOMIC ADVANTAGES

Economic advantages take many forms. The concept is relatively simple: A business can produce something society demands at a price that another cannot. We seek to understand how companies create value and what obstacles exist that preclude competition from entering markets.

GROWTH

We invest in growing businesses within growing industries. We favor those that can do so with modest amounts of incremental capital and with a high degree of predictability.

LEADERSHIP

Management is the link between a business’ underlying economics and shareholder returns. Is leadership investing to increase its capabilities? Is the company focused on customer and other stakeholders’ success? Is growth being pursued with return on capital in mind? Are share repurchases being made in relation to intrinsic value? Does management have skin in the game? These represent just a few of the questions we attempt to answer in understanding the quality of a company’s leadership.

ROBUST FINANCIAL POSITION

Strong financial footing is a must. There is no substitute for cash on hand and abundant free cash flow. We analyze debt levels in the context of cyclicality, the nature of fixed versus variable costs, and capital intensity. Higher amounts of each command more judicious use of financial leverage.